view inc stock spac

Shares of CF Finance Acquisition Corp. By Reuters Staff.

Is the market leader in the Smart Windows space.

. 9 to state that the company wouldnt meet Nasdaqs extended deadline citing an audit announced in August. VIEW stock discussion in Yahoo Finances forum. CFII a SPAC sponsored by Cantor Fitzgerald is set to merge with View Inc.

II CFII debuted in public trading and dipped 3 to 892 a share. Share your opinion and gain insight from other stock traders and investors. View which expects up to 800 million in proceeds from the deal said the combined company would be publicly listed on the Nasdaq after the merger with CF Finance Acquisition.

And CF Acquisition Corp. View to trade on the NASDAQ Stock Market under the ticker VIEW. The total addressable market is huge at 1T.

SoftBank-backed glass manufacturer View is at risk of being delisted less than 9 months after raising 815 million in a SPAC deal. Reuters - Smart-glass maker View Inc said on Monday it would go public through a 16 billion merger with a blank-check company sponsored by Cantor Fitzgerald Co. Operates as a glass-manufacturing company.

II Announce Closing of Business Combination. SPACs bring together experienced management teams often comprising industry veterans private equity sponsors or other financing experts who can leverage their expertise to raise capital to acquire then operate a new public company within 24 months or less a SPAC will find an attractive company to acquire and once that transaction is completed a new publicly. I see the stock at multiples of.

View is a. Exclusion from Shareholder Requirement - Excluding SPAC IPOs from the requirement that certain shareholders hold at least 2500 of stock. View Operating Corporation a technology company develops manufactures and sells smart building products.

Company Type For Profit. According to Insider View filed as recently as Nov. - Ordinary Shares - Class A NASDAQ Updated May 31 2022 557 PM.

View the filing here. Nov 30 Reuters - Smart-glass maker View Inc said on Monday it would go public through a 16 billion merger with a blank-check company sponsored by Cantor Fitzgerald Co. The Company produces a building glass products based on electrochromism.

Reuters - Smart-glass maker View Inc said on Monday it would go public through a 16 billion merger with a blank-check company sponsored by Cantor Fitzgerald Co. Find the latest View Inc. View serves customers worldwide.

The Milpitas smart glass company View began trading on the Nasdaq on Tuesday the end result of a SPAC merger. The stock fell nearly 3 to close at 892. Last Funding Type Post-IPO Equity.

30 an NYC-based SPAC backed by investment banking firm Cantor Fitzgerald agreed to merge and raise capital for a smart glass company based in Silicon Valley called View Inc. After the stockholder meeting on Friday March 5 2021 in a deal valued at 16B. View is the leader in smart building technologies that transform buildings to improve human health and experience reduce energy.

View Net a cloud-connected network infrastructure offering that can incorporate and power. View which expects up. Phone Number 408 263-9200.

VIEW View or the Company the leader in smart building technologies today announced that it expects to complete its finan. The audit uncovered reporting. Find the latest View Inc.

Its product portfolio includes View Smart Glass that comprise electrochromic glass panels in the form of insulating glass units. VIEW stock quote history news and other vital information to help you with your stock trading and investing. View Expects to Complete Financial Restatement and Release Full Year 2021 and Q1 2022 Financial Results in May 2022.

6 hours agoView investors clearly shared Mulpuris optimism today and their sentiment was further buoyed by the company issuing a 2022 sales outlook in the range of 100 million to 110 million -- a nearly. That comes from 500 million in cash held by CFII and 300 million from a private. Legal Name View Inc.

MILPITAS Calif March 28 2022 GLOBE NEWSWIRE -- View Inc. Hub Tags Exited Unicorn. The abysmal performance of businesses that have gone public by merging with special purpose acquisition companies has emboldened the US Securities and Exchange.

This will result in the SPAC merger giving View Smart Windows 800 million of gross proceeds to work with. After 12 years marked by fitful starts and stops View Incs SPAC with CF Finance Acquisition Corp. May 18 2022 932 PM PDT.

II the special purpose acquisition company that Milpitas-based View is merging with dropped below the 10 a share price NasdaqCFII that the SPAC went.

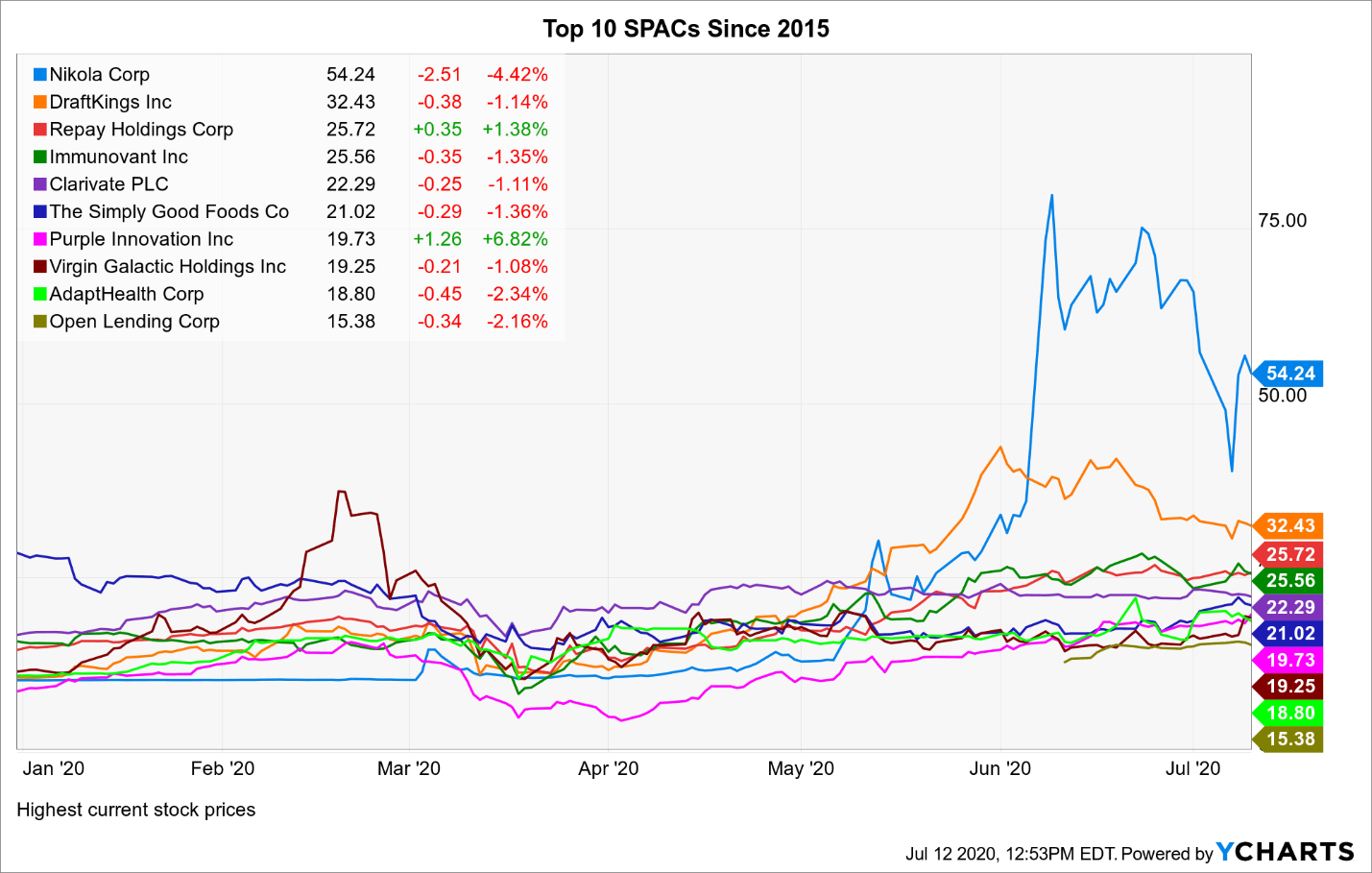

The Greatest Spac Winners From Nikola To Draftkings And Virgin Galactic Nasdaq Dkng Seeking Alpha

View Fails To See A Stock Pop As It Begins Trading On Nasdaq Silicon Valley Business Journal

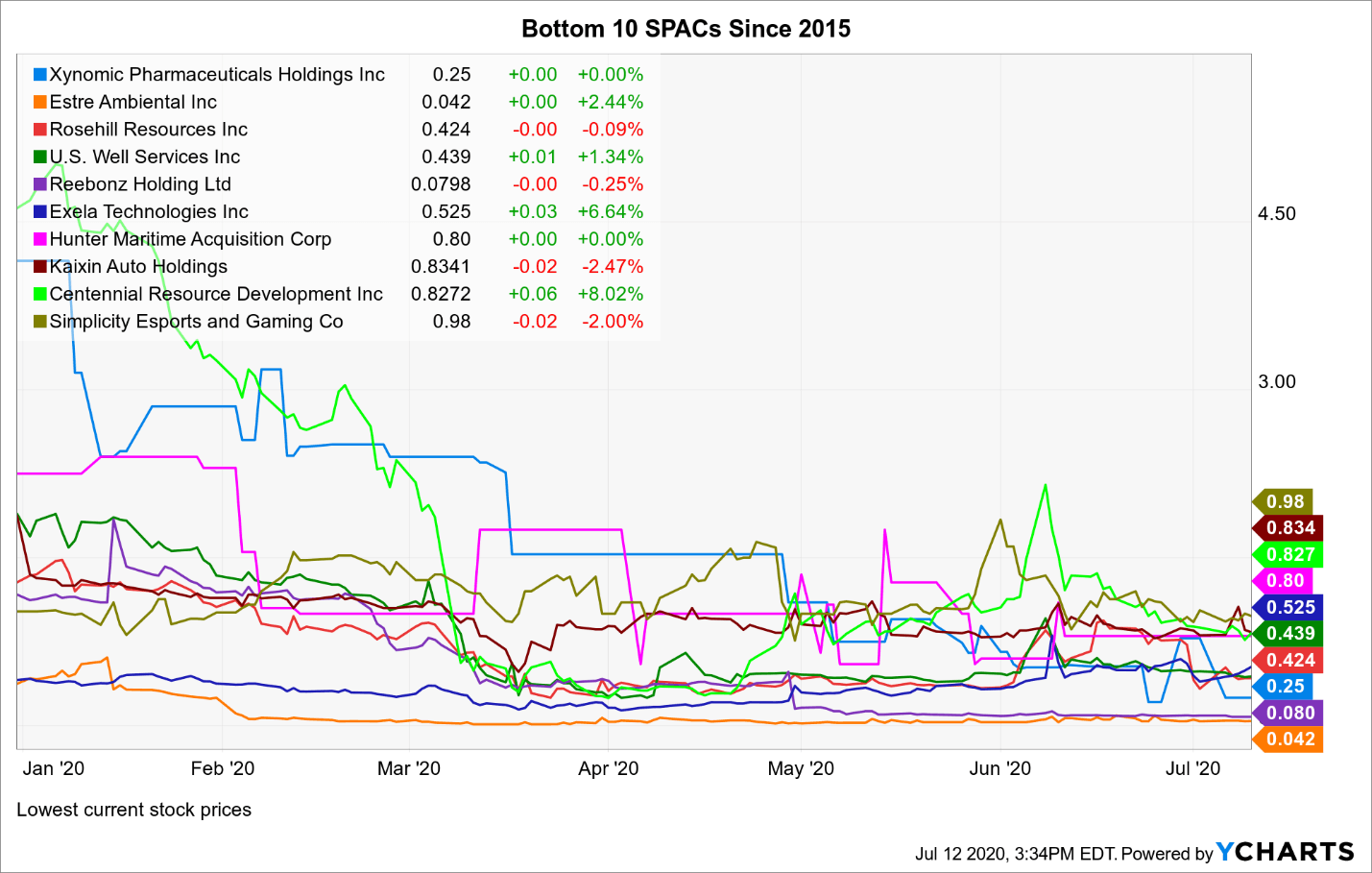

Making A List Of The Best Performing Spac Stocks Of 2020 5 Names To Know Nasdaq

Making A List Of The Best Performing Spac Stocks Of 2020 5 Names To Know Nasdaq

Why This Spac Jumped Another 15 Today The Motley Fool

The Greatest Spac Winners From Nikola To Draftkings And Virgin Galactic Nasdaq Dkng Seeking Alpha

Buy These 3 Spac Stocks Before They Jump 50 Or More Say Analysts Nasdaq

Smart Glass Manufacturer View Facing Delisting The Real Deal

Pin On Investing And Stock Market

Making A List Of The Best Performing Spac Stocks Of 2020 5 Names To Know Nasdaq

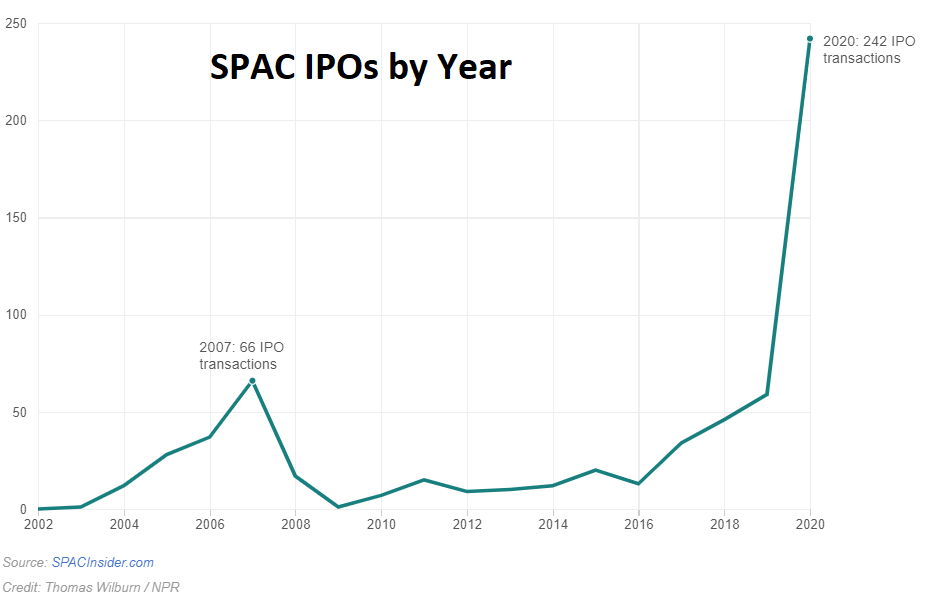

A Spac Risk Exposed Boardroom Alpha

Beware The Spac How They Work And Why They Are Bad Seeking Alpha